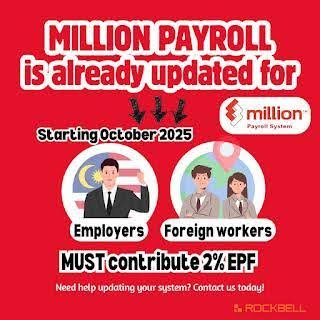

Starting October 2025, all employers in Malaysia will be legally required to contribute to the Employees Provident Fund (EPF) for their non-Malaysian employees. This significant policy change, introduced under Budget 2025, is part of the government’s broader effort to expand social protection coverage to all workers, regardless of nationality.

If you’re an employer in Malaysia who hires foreign workers, it’s important to understand how this change will impact your payroll, compliance obligations, and overall workforce management.

Let’s break it down.

What’s Changing in October 2025?

As announced by the Malaysian government, EPF contributions will become mandatory for foreign workers, including those with valid work permits and employment passes. This move is part of broader labor reforms aimed at ensuring fair treatment for all workers, local or foreign.

Until now, employers have had the option to voluntarily contribute to the EPF for foreign employees. But from October 1, 2025, this will no longer be a choice — it will be a legal requirement.

Who Is Affected by the New EPF Requirement?

The new policy impacts all employers in Malaysia who hire non-Malaysian employees with valid work permits or employment passes, ensuring compliance with the EPF Act.

This includes:

- Workers in manufacturing, construction, services, agriculture, and plantation sectors

- Foreign workers hired through legal employment channels

Who’s Excluded?

- Domestic workers (maids, drivers, cooks, cleaners, babysitters, etc.) are exempt from this mandatory contribution scheme.

- Illegal or undocumented foreign workers are not covered.

According to EPF, employers must also ensure that the workers have valid documentation and permits issued by the Immigration Department of Malaysia.

What Are the Contribution Details?

Under the new ruling:

- Employers and employees each contribute 2% of the worker’s monthly wages to EPF.

- The contributions are fixed and not optional, regardless of salary level.

- These contributions are in addition to any other statutory contributions (e.g. SOCSO, EIS) already applicable.

The EPF clarified that the rate is uniform for all non-Malaysian workers, and no additional tiers or scales will be introduced at this stage.

When Will It Be Implemented?

The new rule takes effect starting from:

- October 2025 salary cycle

- With contributions to be paid by 15 November 2025

This means employers must begin payroll deductions for EPF contributions for non-Malaysian employees starting from their October wages, and remit them to EPF by the usual due date.

Pro tip: Update your payroll system to automate the new deductions and avoid any compliance issues.

Where Does This Apply

This policy is applicable nationwide in Malaysia — across all industries, sectors, and regions — wherever non-Malaysian workers are legally employed.

Both urban and rural businesses are required to comply. Whether you operate a small enterprise, a restaurant, a factory, or a large corporation, if you employ foreign workers, this policy applies to you.

The only exception, again, is for private households employing domestic helpers.

Why Is the Policy Being Introduced?

The Malaysian government, through EPF, aims to provide retirement savings and basic financial security for all workers, including foreign nationals who contribute significantly to Malaysia’s economy.

This move supports:

- National social protection goals

- International labor standards

- Fair and inclusive treatment of all employees

EPF stated in a press release that the expansion of coverage is part of a larger vision to build financial resilience for every worker, ensuring no one is left behind, especially those in vulnerable or temporary positions.

EPF has already conducted over 30 engagement sessions with:

- The Home Ministry

- The Immigration Department

- The Federation of Malaysian Manufacturers

- NGOs and employer groups

- Worker representatives

These sessions are helping EPF to align the policy rollout with the real-world readiness of employers and stakeholders.

How This Affects Your Business

At first glance, this might look like an additional expense or administrative task for the employer. But look closer, and you’ll see potential advantages for the employee.

Improved Worker Satisfaction

Employees who feel valued and protected in their remuneration are more likely to stay longer and perform better.

Better Employer Branding

Complying early and going beyond the minimum helps your company build trust and credibility, especially in industries where employee contributions and payments play a large role.

Avoid Legal Penalties

EPF compliance is not optional — failing to contribute properly could lead to fines, audits, or even legal action.

Smoother Business Operations

Being proactive avoids last-minute scrambling when the employer’s obligations under the EPF Act kick in. Plus, most payroll software providers in Malaysia are expected to release updates to help automate employee contributions.

Timeline at a Glance

September 2025

Employers should begin preparing and updating systems for EPF contributions, especially regarding the contribution rates for their employees.

October 1, 2025

EPF contributions become mandatory for foreign workers

Post-October

Enforcement begins; penalties for late contribution payments for non-compliance may apply.

How to Comply as an Employer?

To ensure a smooth transition, employers should consider the employee contribution rates and the timely submission of the EPF statement.

Step-by-Step Guide:

- Register your company with EPF (if not already done).

Registration for EPF members can be completed online at www.kwsp.gov.my or at any EPF branch.

- Register all eligible non-Malaysian employees under your EPF employer profile.

- Update payroll systems to reflect the new 2% contribution rate from both employer and employee.

- Inform your employees about the new deduction so they understand what the 2% means and how it benefits them.

- Start deducting and contributing from October 2025 wages and submit payments to EPF by the 15th of every month.

- Keep an eye out for updates and attend EPF briefings or webinars if available.

What Happens If You Don’t Comply?

Employers who fail to comply with this mandatory requirement may face:

- Fines or penalties

- Backdated contributions

- Legal action from enforcement agencies

To avoid unnecessary complications, it’s crucial to act early and ensure all documentation and systems are ready before October 2025.

What Happens to the EPF Savings When Workers Return Home?

Foreign workers can apply to withdraw their full EPF savings under the Leaving the Country Withdrawal once their employment ends and they leave Malaysia permanently. To do so, they’ll need to provide documentation such as:

- A copy of their passport showing departure

- Visa cancellation proof

- Letter from the employer confirming the employment end date

This process ensures that foreign workers benefit from their contributions and can take their savings with them when they return home, helping improve financial security after their Malaysian employment.

Helping Foreign Workers Understand Their EPF Rights

It’s also important for employers to communicate clearly with their foreign employees about what EPF is, how it benefits them, and what they need to know about contributions and withdrawals. Consider offering:

- Translated information sheets into workers’ native languages

- Small group briefings or onboarding sessions explaining the change

- Guidance on how to check their EPF account balance via the i-Akaun system

- Support when it’s time to make a withdrawal after leaving Malaysia

This not only builds trust but also reduces confusion and resistance among foreign workers, many of whom may be unfamiliar with EPF.

Million Payroll Software Update: October 2025 EPF Changes

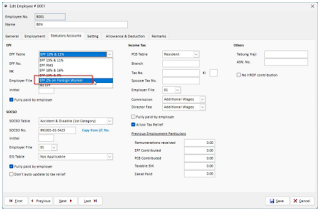

Million Payroll Software has been updated to support the mandatory EPF contributions for non-Malaysian employees, effective October 2025. This update ensures compliance with the new requirement that both employers and non-Malaysian employees (except domestic workers) must each contribute 2% of their monthly wages to EPF.

With this update, you can:

- Automatically calculate the 2% employer and employee EPF contributions.

- Easily register new employees affected by the ruling.

- Generate and submit EPF files through the built-in e-submission feature.

Make sure to review your employee records and run a test payroll if needed to confirm everything is set up correctly for the October cycle.

Check out Million Software for more details.

Final Thoughts

October 2025 may seem far off, but it will arrive sooner than you think. This isn’t just a box-ticking exercise — it’s a chance to build a better employment culture, one that treats all workers fairly.

If you’re an employer, the best thing you can do now is start preparing early. Talk to your payroll provider, like Million Payroll Solution, update your HR protocols, and stay tuned for any detailed guidance from KWSP/EPF as the date approaches.

Whether you employ five foreign workers or fifty, this change affects you. Use this opportunity not only to comply, but to lead with empathy, responsibility, and professionalism.