Running a small or medium enterprise in Malaysia means managing stock, sales, purchasing, tax reporting, and now complying with Malaysia’s E-Invoice and SST requirements. Many businesses still rely on spreadsheets or manual processes, which often lead to stock discrepancies, missing invoices, and tax reporting problems.

A modern inventory management system helps streamline these challenges. And when combined with E-Invoicing + SST support, it becomes a complete business tool for accuracy, compliance, and smoother operations.

What Is an Inventory Management System?

An inventory management system helps SMEs track every stock movement in real time — from purchasing to sales.

Based on Rockbell’s Million Inventory System, key features include:

- Stock Receiving, Issuing & Adjustments

- Stock Transfer between Multiple Locations

- Multi-Warehouse & Multi-Company Support

- Multi-Currency Pricing for import/export businesses

- Bill of Materials (BOM) for assembly or manufacturing

- Serial Number Tracking

- Unit of Measurement (UOM) conversion

- Integration to Accounting & POS modules

These features reduce human errors, prevent over-ordering, and give business owners a clearer view of their true stock levels.

Malaysia E-Invoicing: Why It Matters in 2025

Malaysia is taking a major step toward digitalization with the mandatory e-invoicing initiative under LHDN’s MyInvois platform. Unlike traditional PDFs or printed invoices, an e-invoice is a structured digital document that contains all the critical details of a transaction in a format that computers can read, usually XML or JSON.

What Makes an E-Invoice Different?

An e-invoice is more than just a digital copy of a paper invoice. It is machine-readable, standardized, and carries all the information LHDN requires for verification. Each invoice includes:

- Item description – what goods or services were sold

- Quantity – number of items purchased

- Unit price – price per item

- Discounts – if applicable

- Taxes (SST) – automatically calculated according to current regulations

- Buyer & seller details – business identification and tax registration numbers

- Timestamp – date and time of invoice issuance

- Unique Invoice Reference Number (IRN) – a one-of-a-kind identifier for official use

Once submitted through MyInvois, LHDN validates the e-invoice and returns a QR code plus IRN, which becomes the official, legally recognized invoice for taxation and accounting purposes.

Benefits for SMEs

The shift to e-invoicing is especially beneficial for small and medium-sized enterprises (SMEs), as it solves many of the common challenges of manual invoicing:

Eliminates Manual SST Calculation Errors

Calculating sales and service tax (SST) manually can lead to mistakes, especially when handling discounts, promotions, or multi-rate items. E-invoicing automates this, ensuring accurate tax reporting every time.

Faster Invoice Verification

Invoices submitted via MyInvois are validated instantly. SMEs no longer have to wait for manual checks or risk delays during audits.

Better Audit Trails

Digital e-invoices create a clear, traceable record of every transaction. Each invoice is uniquely identified with an IRN, which simplifies compliance checks and financial reporting.

Reduced Risk of Missing or Duplicated Invoices

Manual invoicing often leads to errors such as missing entries or duplicates, which can cause tax discrepancies or operational headaches. E-invoices prevent this by assigning a unique IRN to every invoice.

Higher Accuracy When Integrating with Inventory and Accounting Systems

Because e-invoices are structured digital files, they can be easily integrated into ERP, accounting, and inventory systems. This allows SMEs to synchronize sales, stock, and financial records automatically, reducing manual data entry and improving overall efficiency.

Why This Matters

For SMEs, adopting e-invoicing is about modernizing business operations. The MyInvois platform streamlines invoicing, reduces errors, and improves record-keeping, which ultimately saves time, lowers costs, and enhances financial transparency.

For businesses ready to embrace digital invoicing, this is a golden opportunity to upgrade their accounting workflows and stay ahead in an increasingly digitized economy.

How SST Works with Inventory & E-Invoicing

Most Malaysian SMEs operate under the Sales and Services Tax (SST) framework. Understanding SST and integrating it properly into your business systems is crucial, especially when adopting e-invoicing.

Understanding SST

SST in Malaysia has two components:

SST Sales Tax (5% or 10%)

This applies to taxable goods that are either manufactured locally or imported. For example, a bakery selling flour-based products would charge 5% SST on ingredients sourced from suppliers, while imported goods like specialty chocolates might incur 10%.

SST Service Tax (6%)

This applies to specific services such as:

- Food and beverage (F&B) services

- Hotel accommodations

- Software and IT services

- Repair or maintenance services

For instance, a café providing dine-in services or a software company delivering subscription services would charge 6% SST on their applicable service fees.

System-Level SST Integration

Manually calculating SST for every transaction can be time-consuming and prone to errors. A SST-enabled inventory or POS system automates this process and ensures compliance. Here’s how:

Automatic SST Assignment

Each product or service can be tagged with the correct SST code in your inventory system. For example, cakes might be tagged with 5% sales tax, while catering services are tagged with 6% service tax. This prevents errors at the point of sale or purchase.

Real-Time SST Calculation

The system calculates the correct SST amount for each transaction automatically, whether it’s a sale or purchase. This ensures accurate billing for customers and proper tax reporting to LHDN.

Recording SST for Reporting

Every SST amount collected or paid is recorded in real time, providing a reliable audit trail. This simplifies monthly or quarterly SST reporting and helps SMEs avoid penalties for mistakes or omissions.

Accurate Reflection in E-Invoices

When integrated with e-invoicing, the SST amount calculated by the system is automatically included in the structured digital invoice. This means the Sales Tax or Service Tax is correctly reflected in the e-invoice data submitted to LHDN via MyInvois.

Example in Practice

Imagine a café selling pastries and coffee. Without SST integration, staff would need to manually calculate 5% SST for goods and 6% for dine-in services separately. Mistakes are common, especially during busy hours.

With an SST-enabled inventory system linked to e-invoicing:

- Pastries are automatically taxed at 5%

- Coffee served on-site is taxed at 6%

- The e-invoice generated for the customer already includes the correct SST

- All records are synced with accounting software for accurate reporting

This automation not only saves time but also reduces the risk of errors, making compliance effortless.

Why Integrate Inventory + E-Invoicing + SST into One System?

For Malaysian SMEs, combining inventory management, e-invoicing, and SST compliance into a single platform isn’t just convenient—it’s a strategic advantage. This integration streamlines operations, reduces errors, and improves overall efficiency. Let’s break down the key benefits:

1. Accurate Real-Time Stock + Sales Sync

When all three systems work together, every transaction updates multiple processes automatically:

- Stock is deducted instantly when a sale is made

- E-invoice is generated immediately with all required details

- SST is calculated automatically based on the item or service

This eliminates the need for manual entries and ensures that sales, stock levels, and tax records are always in sync. For example, a bakery selling 10 cakes can instantly see the stock reduced, the correct SST applied, and the e-invoice ready for submission, all in real time. This level of automation prevents mismatched data, over-selling, and errors in tax reporting.

2. Faster Compliance with LHDN Requirements

Meeting LHDN requirements can be time-consuming if handled manually. An integrated system simplifies the process:

- Buyer details are pre-filled from the database

- SST codes and tax amounts are automatically applied to each item or service

- Item descriptions and quantities are included in a MyInvois-ready format

With this setup, SMEs can generate compliant e-invoices with a few clicks, saving hours of manual work and minimizing the risk of mistakes that could trigger audits or penalties.

3. Better Reporting & Audit Readiness

Integration creates a single source of truth for all financial and operational data. SMEs gain access to comprehensive reports such as:

- Stock movement reports: Track inventory usage and detect shortages or overstock issues

- SST reports: View collected and paid taxes accurately

- Sales reports: Monitor revenue, best-selling items, and customer trends

- E-invoice submission logs: Confirm which invoices have been submitted and validated by LHDN

With all this information consolidated, audits become straightforward and stress-free. There’s no need to cross-check multiple spreadsheets or systems—the data is already accurate, synchronized, and traceable.

4. Prevent Stock and Tax Errors

Manual processes often lead to costly mistakes:

- Wrong SST amounts applied

- Incorrect unit pricing

- Missing invoice serial numbers

- Negative stock due to unsynchronized sales

By automating stock updates, SST calculations, and e-invoice generation, an integrated system eliminates these risks. Staff can focus on customer service and business growth rather than correcting errors or reconciling accounts.

For instance, a café using a manual system might accidentally sell a limited batch of pastries twice, leading to negative stock and accounting headaches. With an integrated platform, the system prevents the sale once inventory reaches zero, automatically generating the correct invoice with SST included.

Why SMEs Should Care

The combination of inventory, e-invoicing, and SST compliance:

- Saves time and manpower by automating repetitive tasks

- Reduces errors that could cost money or trigger audits

- Improves operational visibility and decision-making

- Ensures regulatory compliance with minimal effort

In short, integration transforms what used to be a manual, error-prone process into a smooth, automated, and reliable workflow, giving SMEs a competitive edge in today’s fast-paced business environment.

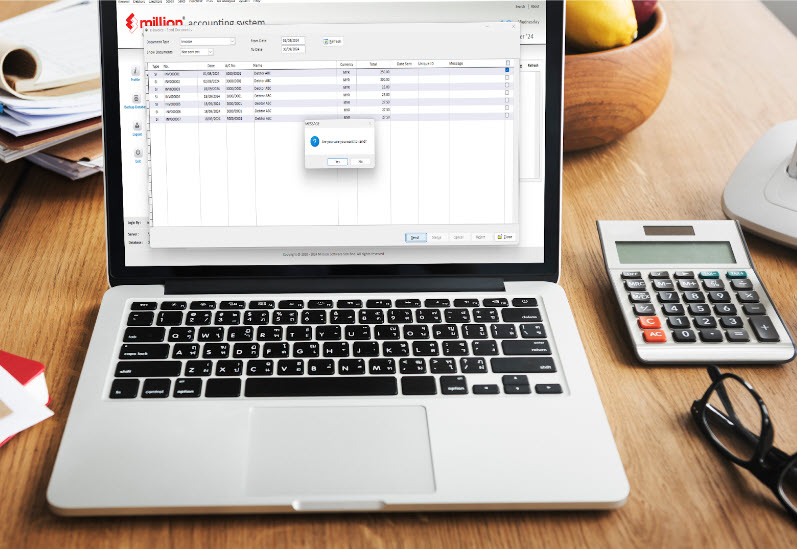

Why Choose Rockbell’s Million Inventory System?

Rockbell’s system is designed specifically for Malaysian SMEs. Key benefits:

- One-time license fee — no monthly subscription

- Fast to learn — 2 to 3 hours of training per company

- Integration with Million Accounting & POS

- Supports SST + E-Invoicing workflow

- Multi-warehouse, multi-company, multi-currency support

- Suitable for retail, wholesale, distribution & F&B

This makes it an ideal solution for SMEs preparing for Malaysia’s digital tax environment.

Get Your Business Ready for 2026

Malaysia is moving steadily toward full digital tax compliance, and 2026 marks a critical year for SMEs to embrace modern business systems. Manual processes for inventory, invoicing, and tax reporting are no longer sustainable—they are time-consuming, error-prone, and leave your business vulnerable to compliance issues.

To stay ahead, SMEs should adopt solutions that integrate:

- Inventory management: Track stock in real time, prevent shortages, and manage replenishment efficiently.

- E-invoicing: Generate LHDN-compliant invoices automatically, reducing errors and speeding up customer billing.

- SST reporting: Ensure all sales and service taxes are calculated correctly and submitted without hassle.

- Accounting integration: Sync financial data seamlessly for accurate reporting, audits, and business insights.

A combined system like Million Inventory System not only simplifies daily operations but also ensures your business is fully compliant, accurate, and efficient. Automation reduces manual work, minimizes errors, and gives you more time to focus on growth and customer satisfaction.