Malaysia is undergoing a major shift in its taxation framework. The Inland Revenue Board of Malaysia (LHDN) is rolling out the mandatory e-Invoicing system, set to revolutionize the way businesses issue and submit invoices. The transition is a vital part of the government’s push to modernize the country’s tax collection processes and ensure greater efficiency and transparency. For businesses in Malaysia, this change represents an important milestone.

Among the many sectors impacted by this shift, the Food and Beverage (F&B) industry stands out as one of the most affected. Known for its high transaction volume, complex order management, and diverse payment methods, the F&B sector has unique challenges when it comes to adopting e-Invoicing. Ensuring LHDN compliance in this fast-paced environment requires the right tools, and that’s where a modern Point-of-Sale (POS) system with e-Invoice integration becomes essential.

What is e-Invoicing?

e-Invoicing is the electronic generation, transmission, and storage of invoices. Under Malaysia’s new tax system, businesses must submit electronic invoices to LHDN for validation before sharing them with customers. The e-Invoice system aims to reduce fraud, streamline tax reporting, and improve auditability by eliminating manual paper-based processes.

The new e-Invoicing system is being implemented in phases, with businesses gradually being required to comply. The goal is to fully integrate it into the nation’s tax administration system, allowing LHDN to validate invoices in real time and track transactions more accurately.

The Challenges Faced by F&B Businesses in Malaysia

The F&B industry in Malaysia faces several operational challenges that make it particularly vulnerable to the complications of adopting an e-Invoicing system in Malaysia.

Let’s take a closer look at some of the specific pain points:

1. High Transaction Volumes

F&B businesses often deal with a large number of daily transactions. Whether it’s a bustling café, a fast food outlet, or a high-end restaurant, the volume of orders and transactions each day is significant. Managing this influx manually or with outdated systems can result in delays, errors, and inconsistencies in the invoicing process.

2. Split Payments

It’s not uncommon for customers to split their payments in multiple ways—cash, credit card, e-wallets, and loyalty points. Each of these payment methods requires a different invoicing treatment. Without a POS system that integrates with LHDN’s e-Invoice system, managing these transactions in a way that complies with tax regulations can be extremely challenging.

3. Frequent Order Modifications

In the F&B industry, customers often make changes to their orders—whether it’s adding extra toppings, modifying the size of a dish, or requesting special modifications. These adjustments require real-time updates to invoices and can easily result in discrepancies if managed manually.

4. Dine-In vs Takeaway Taxes

In Malaysia, the tax treatment for dine-in and takeaway orders can differ, adding complexity to the invoicing process. Ensuring that the correct tax is applied based on the order type is critical for maintaining compliance, and doing this manually is prone to errors.

Why e-Invoicing Matters for F&B Businesses in Malaysia

Given the operational complexities of the F&B industry, a POS system with e-Invoice integration offers several key advantages:

1. Improved Efficiency

A POS system with integrated e-Invoicing allows businesses to automatically generate invoices in real time, submit them to LHDN for validation, and immediately share them with customers. This level of automation significantly reduces manual work, saving time for staff, allowing them to focus on more critical tasks.

2. Real-Time Tax Compliance

With LHDN’s mandatory e-Invoicing system, businesses need to ensure that every invoice is validated before it reaches the customer. A POS system with e-Invoice integration ensures that businesses stay compliant by submitting invoices to LHDN in near real-time. This eliminates the risk of penalties or late filings.

3. Error Reduction

Handling a high volume of transactions manually or using outdated systems is prone to human error. By automating the invoicing process, a POS system reduces mistakes, ensuring that every invoice is generated correctly with accurate data, such as taxes, payment methods, and transaction details.

4. Seamless Integration with LHDN

An integrated POS system simplifies the process of submitting invoices to LHDN by directly linking the system to the tax authority’s platform. This ensures that all invoices are submitted without delay and in full compliance with Malaysian tax regulations.

5. Improved Record Keeping and Audit Trail

A POS system with e-Invoice integration maintains a detailed digital record of every transaction, which can be easily accessed for auditing purposes. This helps F&B businesses keep track of their sales, taxes, and invoicing history for reporting and compliance purposes.

How to Use e-Invoicing with the Popcorn POS System

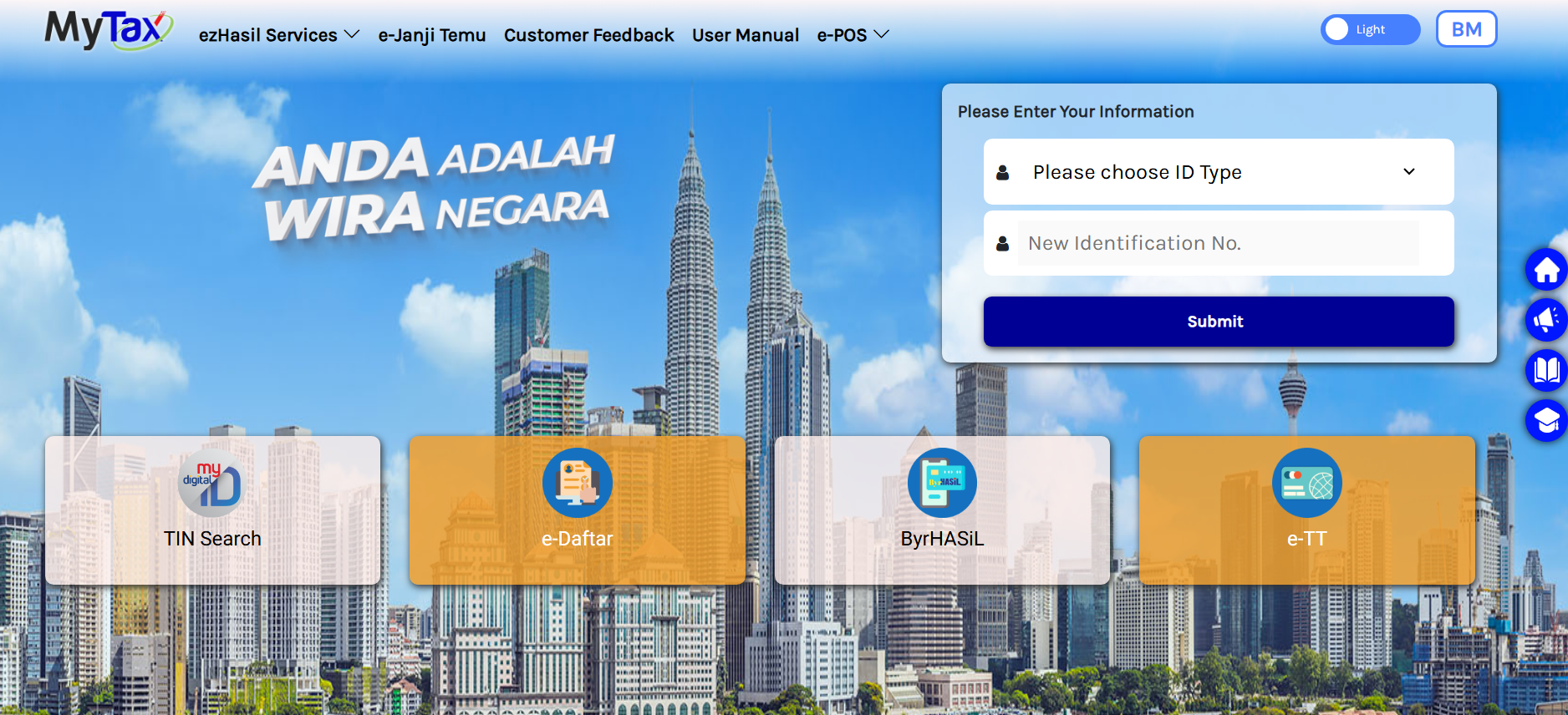

Step 1: Register for a MyTax Account

The first step in integrating e-Invoicing with your POS system is to register for a MyTax account, which is the official LHDN portal for tax reporting. This account will serve as the gateway for submitting your invoices electronically.

Step 2: Activate e-Invoice Settings in Popcorn

Once you’ve registered for MyTax, log in to the Popcorn POS system and navigate to the “Outlet Setting” section. Activate the e-Invoice feature, which will allow the system to automatically generate and submit invoices directly to LHDN.

Step 3: Submit Consolidated e-Invoices Monthly

Each month, before the 7th, you must submit your consolidated e-Invoice report via Popcorn’s backend. This submission is crucial for staying compliant with LHDN’s e-Invoicing requirements and ensuring that all transactions are correctly validated by the tax authorities.

Step 4: Handle Customer e-Invoice Requests

If a customer requests an e-Invoice, you can easily provide it by entering their email address during checkout or allowing them to scan a QR code on the receipt. This flexibility ensures that customers have access to their e-Invoices instantly, which is an important convenience factor for many.

Step 5: Access e-Invoice Reports Anytime

Popcorn POS keeps a detailed record of all your submitted invoices. You can access these reports anytime through the backend system, which is useful for internal audits, reporting, or resolving any discrepancies that may arise.

Benefits of Adopting Popcorn POS for e-Invoicing

While Popcorn POS makes LHDN compliance simple, there are additional benefits that come with using a modern POS system designed for the F&B industry:

1. Speed and Accuracy

With real-time invoicing and automatic submission, Popcorn POS eliminates the delays and errors associated with manual invoicing. This ensures faster transactions and helps to keep your business running smoothly, even during peak hours.

2. Data Security

The integration between Popcorn POS and LHDN ensures that sensitive transaction data is transmitted securely, reducing the risk of data breaches and ensuring that your business meets data protection regulations.

3. Scalability

As your business grows, Popcorn POS can easily scale with your needs. Whether you’re managing a single outlet or multiple locations, the system can accommodate higher volumes of transactions and keep your invoicing process efficient.

4. Integration with Other Business Operations

Popcorn POS offers features that integrate with inventory management, sales analytics, and financial reporting. This means that every sale made through the system is recorded accurately, and data is synced seamlessly across different business functions, improving your overall operational efficiency.

Future-Proofing Your F&B Business with e-Invoicing and POS Systems

The rapid evolution of digital payment technologies and tax regulations presents a unique challenge for businesses, particularly those in the F&B industry, where adaptability is key. Implementing a POS system with integrated e-Invoicing is not just about meeting current regulatory requirements—it’s about preparing for the future.

Stay Ahead of Emerging Trends

The rise of cashless payments, mobile wallets, and contactless technology is already shaping the future of business operations. By adopting an e-Invoicing-enabled POS system, F&B businesses can position themselves at the forefront of technological advancements, ensuring they remain competitive in an increasingly digital market.

As e-payment methods continue to grow, a POS system that can seamlessly integrate with these platforms provides businesses with the flexibility to handle diverse payment methods while maintaining tax compliance.

Scalability for Growth

As your business expands, so does the complexity of managing sales, inventory, and compliance. A scalable POS system ensures that as your operations grow, you can continue to generate e-Invoices and submit them to LHDN without significant disruption. This scalability also extends to reporting capabilities, allowing businesses to handle larger volumes of transactions and more complex financial data without compromising accuracy.

Additionally, a future-proof POS system enables businesses to integrate with other software tools like inventory management, CRM systems, and loyalty programs, creating an ecosystem that enhances both operational and customer service efficiencies.

Conclusion

The introduction of e-Invoicing in Malaysia is not merely a regulatory requirement but a golden opportunity for businesses, particularly in the F&B sector, to streamline their operations, improve financial transparency, and ensure long-term sustainability.

A POS system with integrated e-Invoice functionality provides businesses with the tools needed to comply with LHDN regulations, automate invoicing, and enhance financial reporting.

Further, embracing this technology helps F&B businesses not only ensure compliance but also pave the way for future-proofing their operations. With improved efficiency, better financial oversight, and scalable growth potential, POS systems like Popcorn POS offer a comprehensive solution to meet both current and future needs.

Want to know more about how Popcorn POS can simplify your invoicing process?

Contact us today for a free demo of our F&B POS system or to speak with our team — we’re happy to help you get started!