Year-end payroll can be one of the most stressful times for businesses in Malaysia. Between calculating bonuses, generating EA Forms, and ensuring EPF, SOCSO, and PCB submissions are accurate, HR teams and business owners often feel overwhelmed.

If you’re still managing payroll manually or using outdated systems, mistakes can slip through, leading to delays, penalties, or employee dissatisfaction. Million Payroll Software is designed to take the stress out of year-end payroll, helping you close the year efficiently, accurately, and confidently.

Why Year-End Payroll Matters

Year-end payroll isn’t just about paying salaries or bonuses. It’s a critical compliance period that affects your employees, your business reputation, and your legal obligations. Employers are required to:

- Generate and distribute EA Forms to all employees

- Submit the employer’s E Form to LHDN before the deadline

- Ensure EPF, SOCSO, EIS, and PCB contributions are correctly calculated and submitted

- Handle bonus payments, salary adjustments, and leave encashments accurately

Errors during this period can lead to financial penalties, employee dissatisfaction, or audit issues. A reliable payroll system ensures your business stays compliant and organised, even during the busiest months.

How Million Payroll Helps You Handle Year-End Stress

Million Payroll is a powerful and easy-to-use Malaysia payroll software designed to automate and simplify your monthly and annual payroll tasks. Here’s how it helps during year-end:

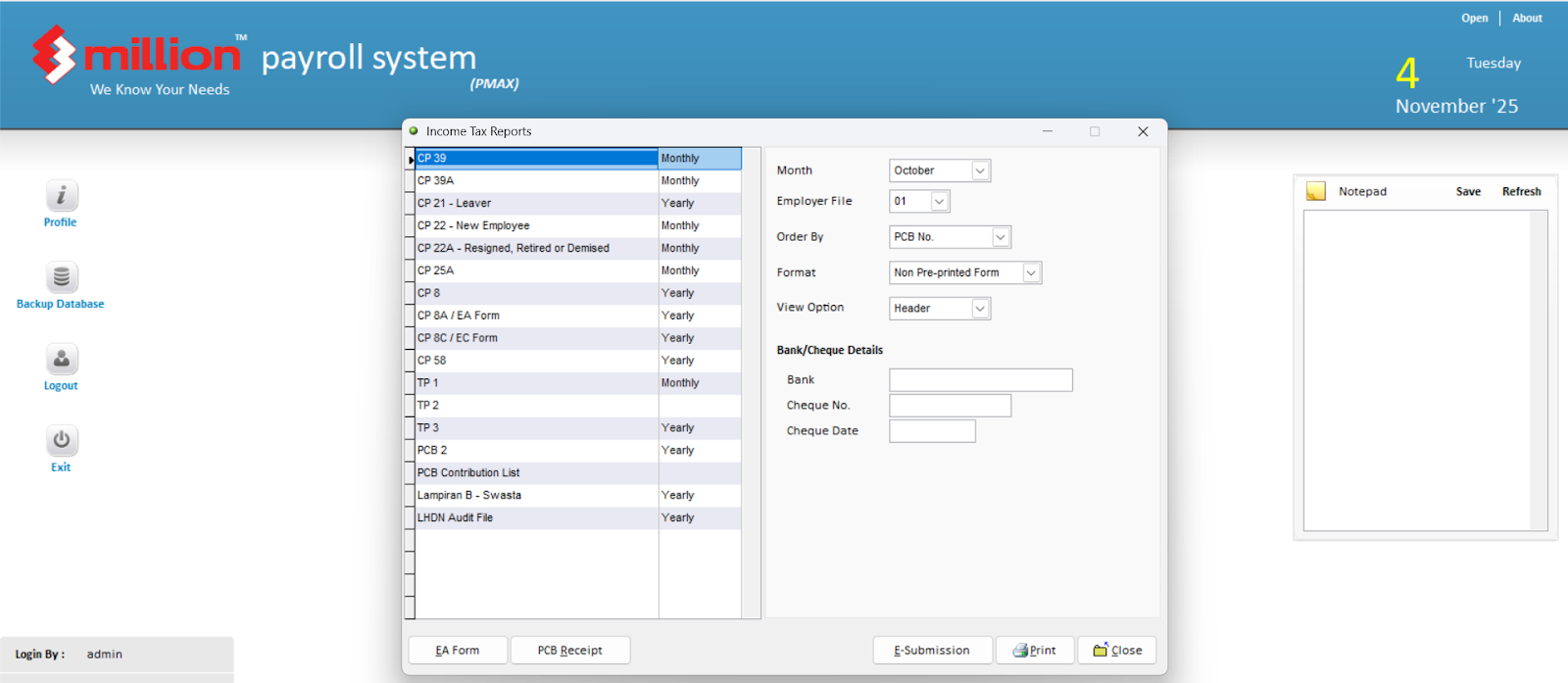

1. Auto-Generate EA & E Forms

Generating EA Forms manually is time-consuming and prone to errors. Million Payroll:

- Creates EA Forms for each employee automatically

- Prepares the employer’s E Form for LHDN submission

- Reduces hours of repetitive manual work, ensuring accuracy and compliance

Example: A medium-sized business with 50 employees saved over 20 hours in EA Form preparation alone by switching to Million Payroll.

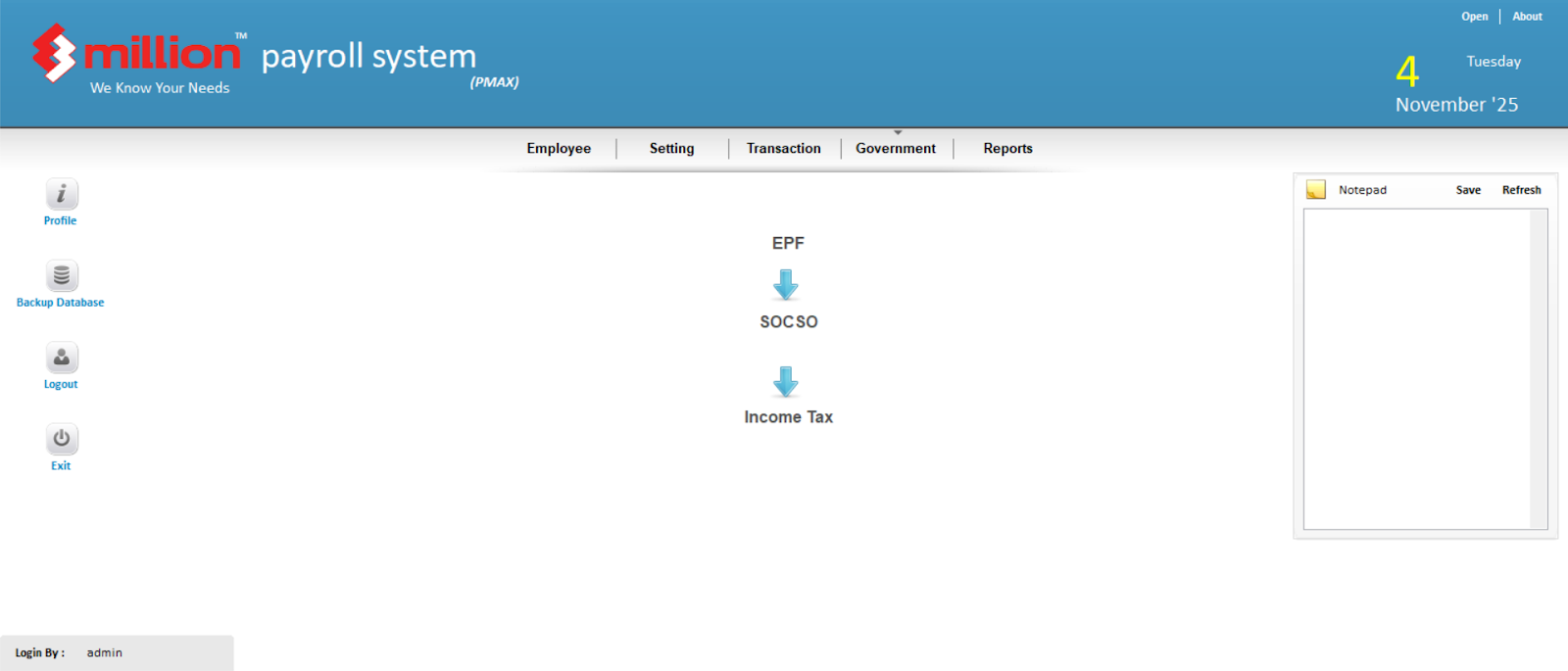

2. Accurate Statutory Contributions

Million Payroll is always updated with current EPF, SOCSO, EIS, and PCB rates, ensuring:

- All calculations are error-free

- Your submissions are fully compliant with Malaysian statutory requirements

- Manual adjustments and cross-checking are no longer necessary

Pro Tip: Regularly update employee details and contribution rates in the system to ensure ongoing compliance throughout the year.

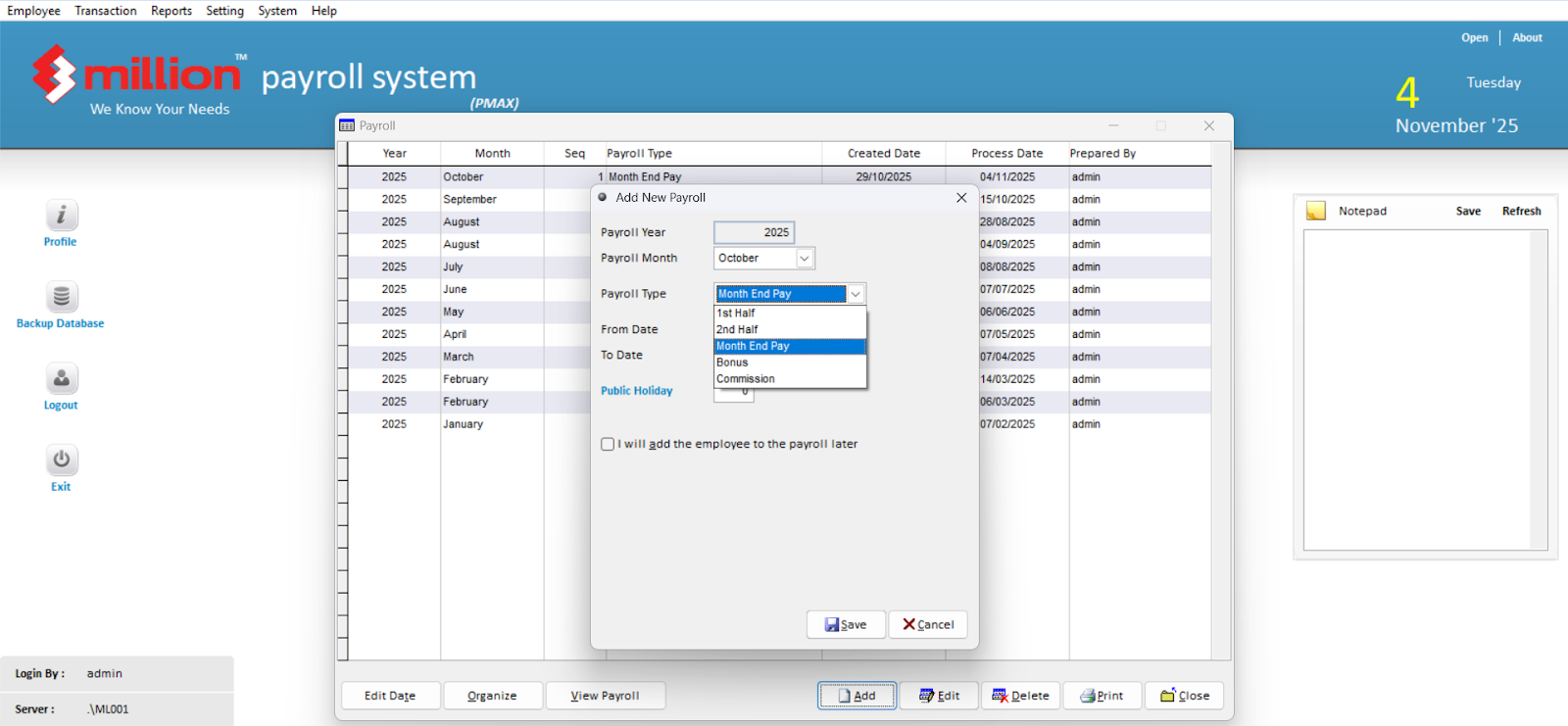

3. Easy Bonus & Adjustment Management

Year-end bonuses, commissions, or salary revisions can complicate payroll calculations. Million Payroll simplifies this by:

- Allowing you to key in bonuses and adjustments quickly

- Automatically recalculating deductions and contributions

- Updating employee payslips instantly

Example: A retail company managing seasonal bonus payments for 100 employees reduced errors to zero after switching from spreadsheets to Million Payroll.

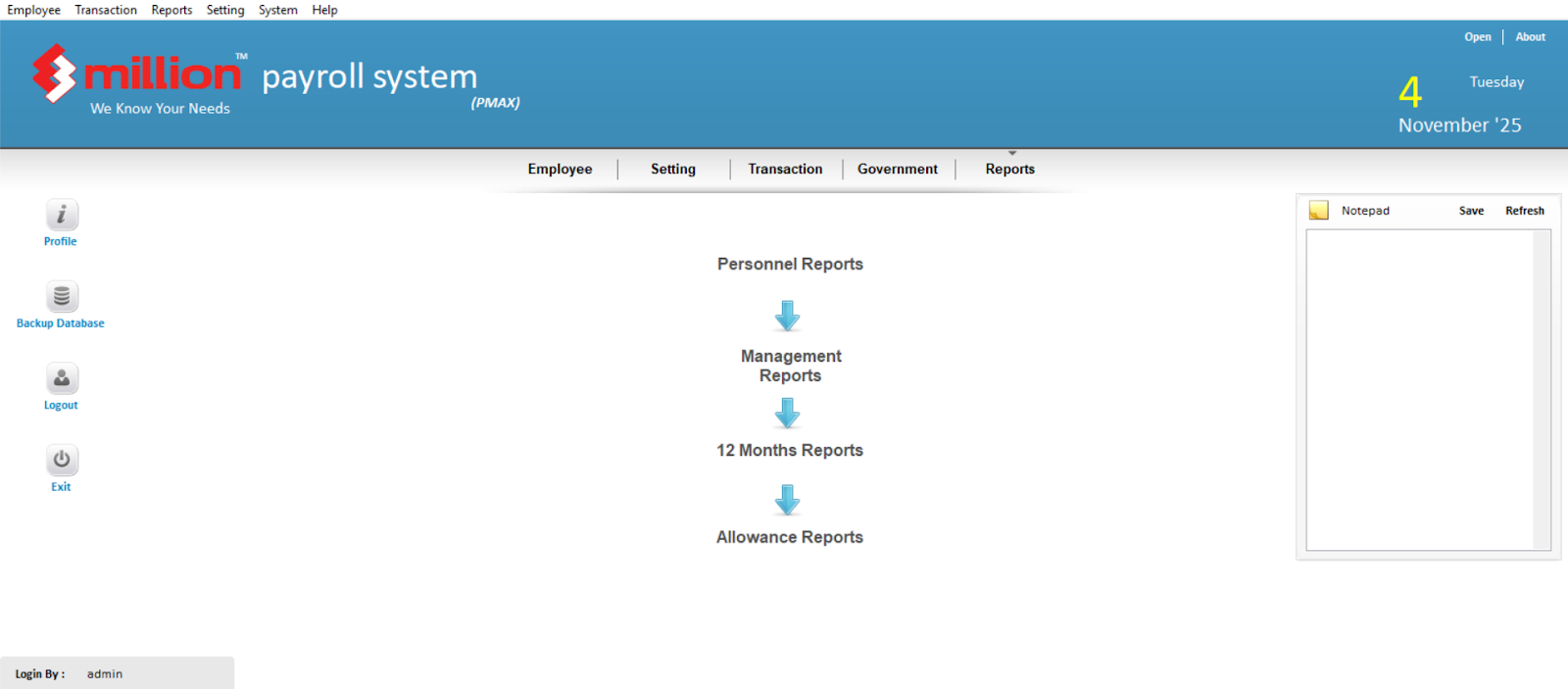

4. Comprehensive Reporting

Million Payroll offers detailed reporting for auditing, management review, or regulatory submissions:

- Generate reports for EPF, SOCSO, EIS, PCB, and payroll summaries

- Keep your HR and finance teams organised and audit-ready

- Export reports in multiple formats for easy sharing with management or authorities

Tip: Use these reports to review payroll trends, plan for next year’s budget, and identify potential areas of improvement.

Additional Benefits of Million Payroll

Beyond simplifying year-end payroll, Million Payroll also offers:

- LHDN-approved software: Trusted and compliant for Malaysian businesses

- User-friendly interface: No payroll expertise required

- Secure data handling: Protect sensitive employee information

- Scalability: Suitable for SMEs and growing companies

- Time-saving automation: Reduce manual workload significantly

Example: SMEs with fewer HR staff can process payroll for hundreds of employees within minutes, freeing up time for strategic HR and business tasks.

Common Payroll Challenges and How Million Payroll Solves Them

Even businesses using software sometimes encounter payroll challenges. Million Payroll addresses common issues such as:

- Manual Calculation Errors – Automates EPF, SOCSO, PCB, and bonuses

- Late Submissions – Keeps deadlines in check with automated reminders

- Inaccurate Employee Records – Centralised database ensures consistency

- Complex Bonus Structures – Handles multiple bonus types with automatic recalculations

Pro Tip: Schedule regular data audits within Million Payroll to ensure employee records, leave balances, and contribution rates are always up-to-date.

Preparing Your Business for a Smooth Year-End

Year-end payroll can feel overwhelming if your team isn’t prepared. To make the most of Million Payroll and avoid last-minute stress, follow these steps:

1. Update Employee Information

Accurate employee data is the foundation of error-free payroll. Ensure that all salaries, bonuses, allowances, deductions, and leave balances are up-to-date in the system.

Why it matters: Even small errors in salary or deduction entries can lead to incorrect EA Forms, miscalculated statutory contributions, or employee dissatisfaction.

Tip: Conduct a quick internal audit before year-end to verify that all employee records are complete and correct.

2. Check Statutory Contribution Rates

Malaysia’s statutory contributions may change annually. Million Payroll automatically updates these rates, but it’s wise to review them before finalising payroll.

Why it matters: Ensuring contributions are correct prevents penalties from LHDN or other regulatory bodies and maintains employee trust.

Tip: Keep a simple reference chart of statutory rates for quick verification, and double-check any newly updated rates in Million Payroll before processing.

3. Plan Payroll Schedules Around Deadlines

Year-end payroll involves multiple deadlines, such as submitting EA Forms to employees and filing E Forms to LHDN. Plan your payroll runs and processing dates accordingly

Why it matters: Proactive scheduling prevents last-minute rushes, avoids human errors, and ensures all statutory submissions are completed on time.

Tip: Use Million Payroll’s scheduling features to set reminders for bonus payments, statutory submissions, and report generation. A well-planned schedule keeps your team organised and reduces stress.

4. Leverage Payroll Reports to Anticipate Issues

Million Payroll generates comprehensive reports for EPF, SOCSO, PCB, bonuses, adjustments, and overall payroll summaries. Use these reports to:

- Identify missing or incorrect entries before submission

- Spot trends or anomalies in bonuses, overtime, or deductions

- Prepare audit-ready documentation for management or LHDN

Why it matters: Reviewing reports in advance allows you to catch potential issues early, saving time and preventing compliance problems.

Tip: Schedule a mid-year payroll review as well. Checking reports periodically makes year-end preparation smoother and reduces last-minute surprises.

Pro Tip: Treat Your Payroll System as a Strategic Tool

Year-end payroll is also an opportunity to streamline operations, reduce errors, and improve HR efficiency. Million Payroll can become a strategic part of your business:

- Forecast payroll costs for next year based on bonuses, salary adjustments, and statutory contributions

- Analyse trends in overtime, leave encashments, and bonus payouts

- Enhance employee satisfaction by ensuring accurate and timely payments

Integrating Million Payroll into your year-end strategy makes payroll less of a chore and more of a tool to support business planning and growth.

Top Year-End Payroll Mistakes to Avoid

Even with the best payroll software, businesses can run into common pitfalls during year-end. Knowing what to watch out for can save your HR team time, stress, and potential penalties.

1. Delaying Payroll Preparation

Procrastination is the biggest enemy of accurate year-end payroll. Waiting until the last week to process bonuses, generate EA Forms, or reconcile statutory contributions increases the risk of errors.

Solution: Start your year-end payroll preparation at least a month in advance. Million Payroll’s automated features allow you to begin generating reports, checking statutory contributions, and updating employee data well ahead of deadlines.

2. Overlooking Employee Data Updates

Employee changes throughout the year — salary adjustments, promotions, resignations, or new hires — can easily be missed. Inaccurate employee data leads to miscalculated payroll and faulty EA Forms.

Solution: Conduct a data audit before year-end. Ensure all employee records in Million Payroll are complete and up-to-date.

3. Ignoring Statutory Rate Changes

EPF, SOCSO, EIS, and PCB rates can change from year to year. Manually tracking these rates increases the likelihood of errors and compliance issues.

Solution: Million Payroll automatically updates statutory rates, but it’s good practice to double-check them before final payroll runs.

4. Failing to Double-Check Reports

Even with automation, errors can occur due to incorrect entries or system misconfigurations. Failing to review payroll reports can result in late submissions or mispayments.

Solution: Always review Million Payroll reports before finalising year-end processing. Look for anomalies in salaries, bonuses, deductions, and contributions.

5. Not Planning for Bonus and Leave Adjustments

Year-end bonuses, commissions, and leave encashments are often calculated manually, which can create confusion and mistakes.

Solution: Use Million Payroll’s bonus and adjustment features to automatically recalculate deductions and update payslips, ensuring employees receive accurate payments on time.

Avoiding these common mistakes can help businesses enjoy a smooth, stress-free year-end payroll. Using Million Payroll not only reduces errors but also saves time, ensures compliance, and boosts employee satisfaction.

Why Choose Million Payroll

- LHDN-approved software

- Complies with Malaysian statutory requirements

- User-friendly interface — no payroll expertise required

- Secure data handling

- Suitable for SMEs and growing companies

Thousands of Malaysian businesses trust Million Payroll to handle their payroll efficiently every month. Whether you manage 5 employees or 500, you can rely on Million to make your payroll simple, fast, and accurate.

Don’t wait until the last minute to handle your year-end payroll. Let Million Payroll take care of the calculations, forms, and compliance, so you can focus on what matters most: growing your business. Contact Rockbell now!